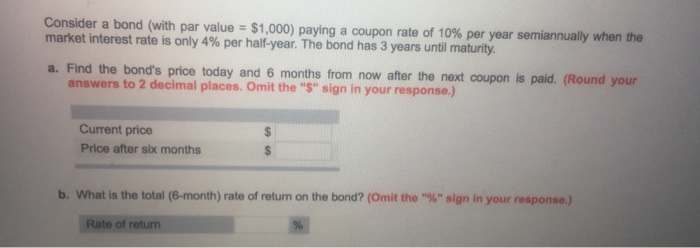

43 consider a bond paying a coupon rate of 10 per year semiannually when the market

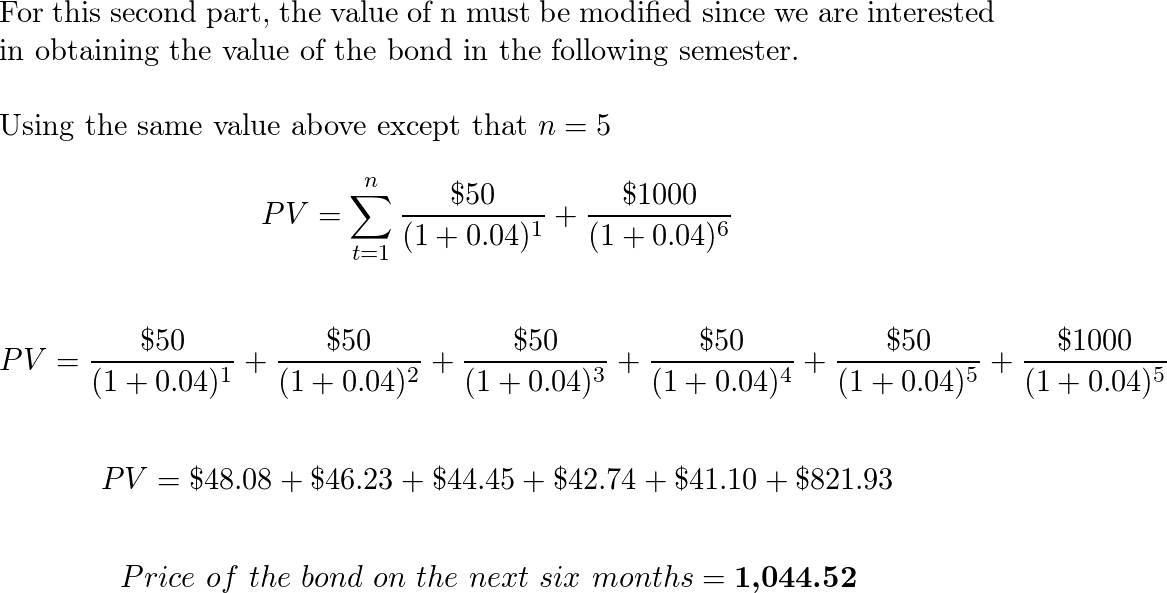

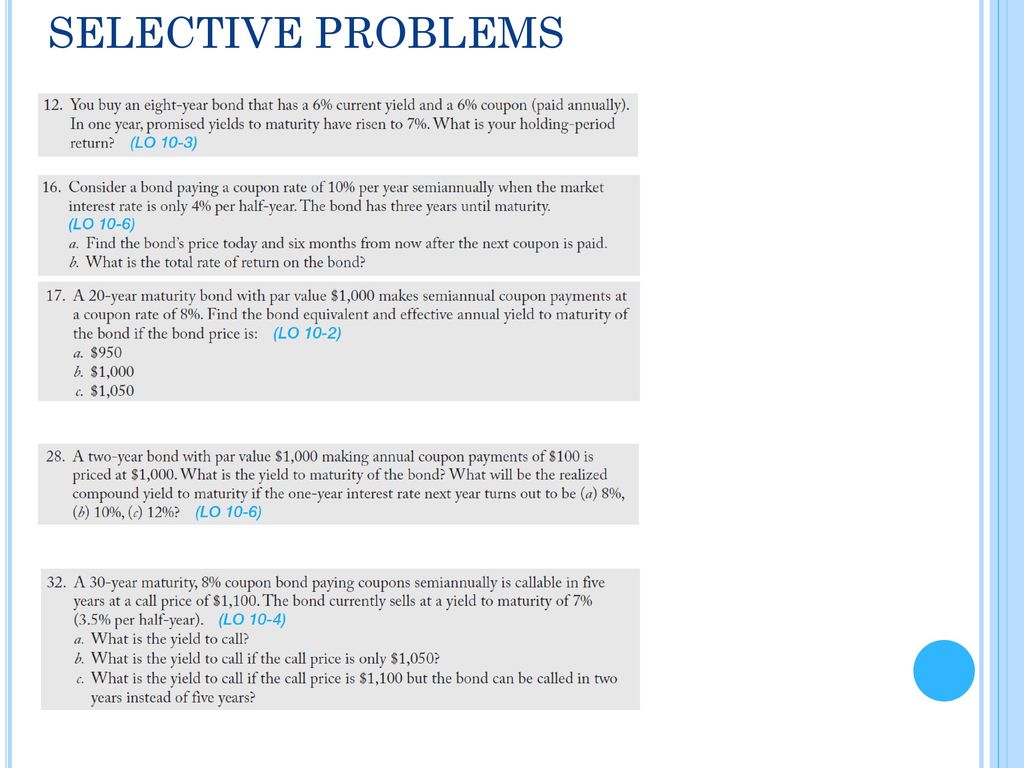

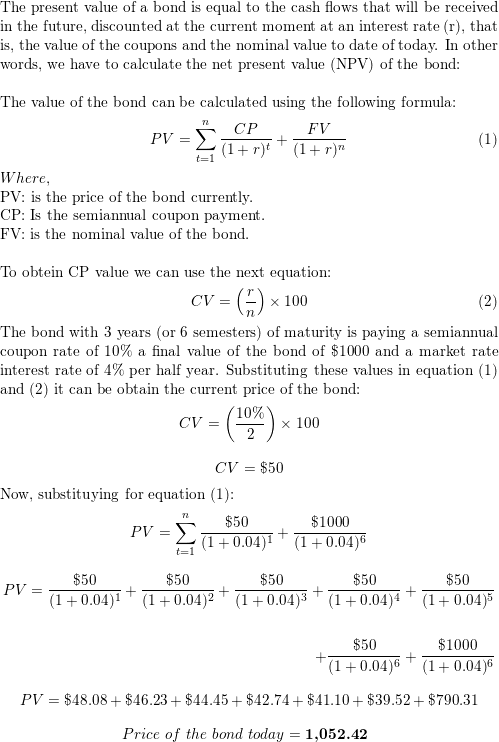

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Consider a bond paying a coupon rate of 10% per year...open 5 Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Jun 29 2021 | 10:57 AM | Solved

U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

Consider a bond paying a coupon rate of 10 per year semiannually when the market

How Do Bond ETFs Work? | ETF.com A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid.

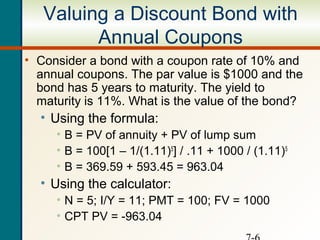

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year. Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Expert solutions Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions Publication 550 (2021), Investment Income and Expenses You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. Investing: how do I buy government bonds or corporate bonds on the ASX? If you bought a $1000 bond with a 5 per cent interest rate or coupon rate, your coupon payment will be $50 per year. Yield: The yield compares the coupon rate to the current market price of the bond.

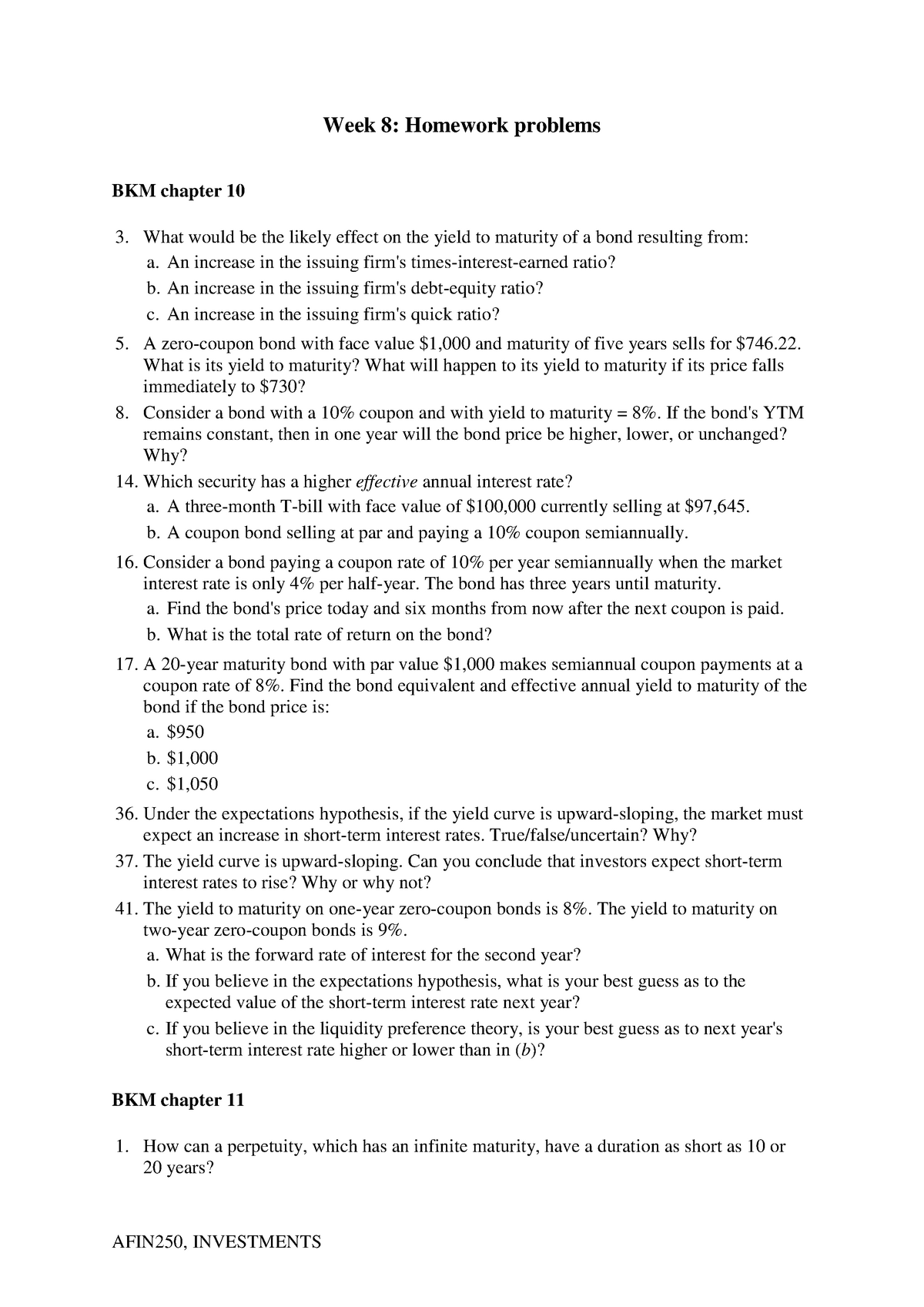

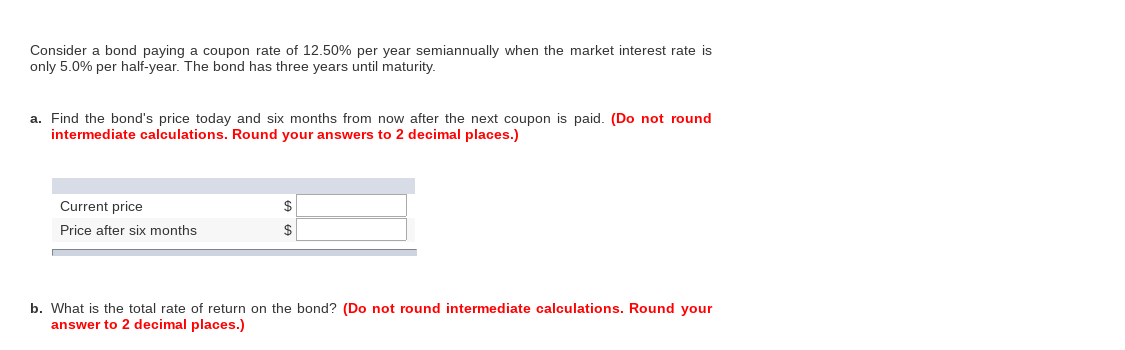

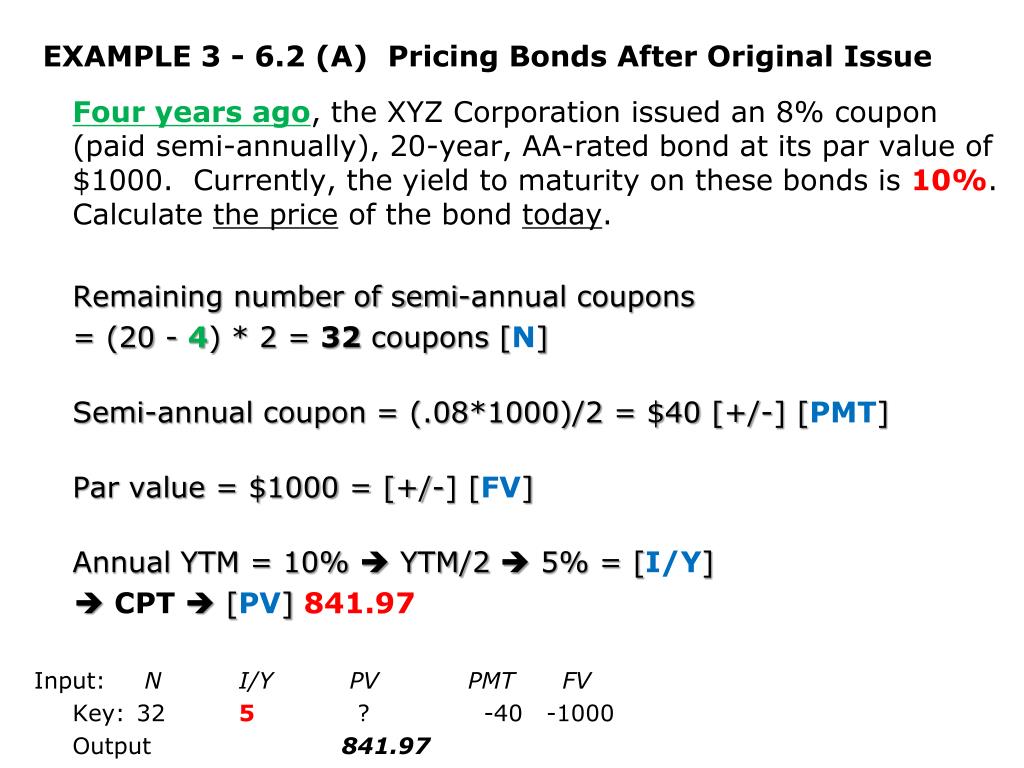

Answered: 1. Consider a 30-year U.S. bond paying… | bartleby Business Economics 1. Consider a 30-year U.S. bond paying 8 percent coupon. The interest is 10 percent. a. Find the bond's Macaulay duration. Make sure to show your work b. Find the bond's Modified duration. Make sure to show your work c. If the interest rate falls by 10 basis points, what is the exact percentage change in the bond price? SOLVED: Renfro Rentals has issued bonds that have a 12% couponrate ... Mm, hmm The bond matures in eight years, and whitey is given to be 8.5. I think that's Mhm. We need to find out how much the bond is worth. First of all, we have to find the coupon payment for period. The face value of the bond is 1000, the coupon rate is 10% and it is being paid semi annually. One x two. It comes to $50. $50 is paid per pair. Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Question: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid. b) What is the total rate of return on the bond? Dec 28 2021 | 05:26 PM | Solved Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is t SEC.gov | HOME The interest factor for each day is computed by dividing the interest rate applicable to that day: by 360 in the case of CMS rate notes, commercial paper rate notes, EURIBOR notes, federal funds rate notes and prime rate notes; and by 365 (or the actual number of days in the year) in the case of CMT rate notes and treasury rate notes. Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond?

Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

Success Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. Do My Paper. Essay Help for Your Convenience. ... We offer the lowest prices per page in the industry, with an average of $7 per page. Success Essays Features. Get All The Features For Free. $11. per page. FREE Plagiarism report.

I Bond Returns: Almost Too Good To Be True - Financial Samurai Dec 15, 2021 · The true risk-free rate is the 10-year bond yield since there is no cap on how much one can purchase. However, the I Bond yield is also a worthwhile risk-free rate. ... We also know the average return for the aggregate bond market is around 5%. Therefore, if you construct a simple 60/40 portfolio, the expected return based on historical figures ...

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? This problem has been solved!

Assignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. Do My Paper. Essay Help for Your Convenience. ... We offer the lowest prices per page in the industry, with an average of $7 per page. Assignment Essays Features. Get All The Features For Free. $11. per page. FREE Plagiarism report.

Great-West Lifeco announces pricing of €500 million senior fixed rate ... This is Great-West Lifeco's third debt issuance in the euro market. The €500 million, 7-year bonds are denominated in euros and will pay an annual coupon of 4.700%, priced at par. The bonds are ...

Consider a bond paying a coupon rate of 10% per year semiannually when ... Using a financial calculator , you can solve for bond price with the following inputs; Maturity of bond (as of today); N = 3*2 = 6 Face value ; FV = 1000 Semiannual coupon payment; PMT = (10%/2 )*1000 = 50 Semiannual interest rate; I/Y = 4%/2 = 2% then CPT PV = $1,168.04 6-months from today, you will use the following inputs to find new price;

Achiever Papers - We help students improve their academic … With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

How Do Bond ETFs Work? | ETF.com A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

Post a Comment for "43 consider a bond paying a coupon rate of 10 per year semiannually when the market"