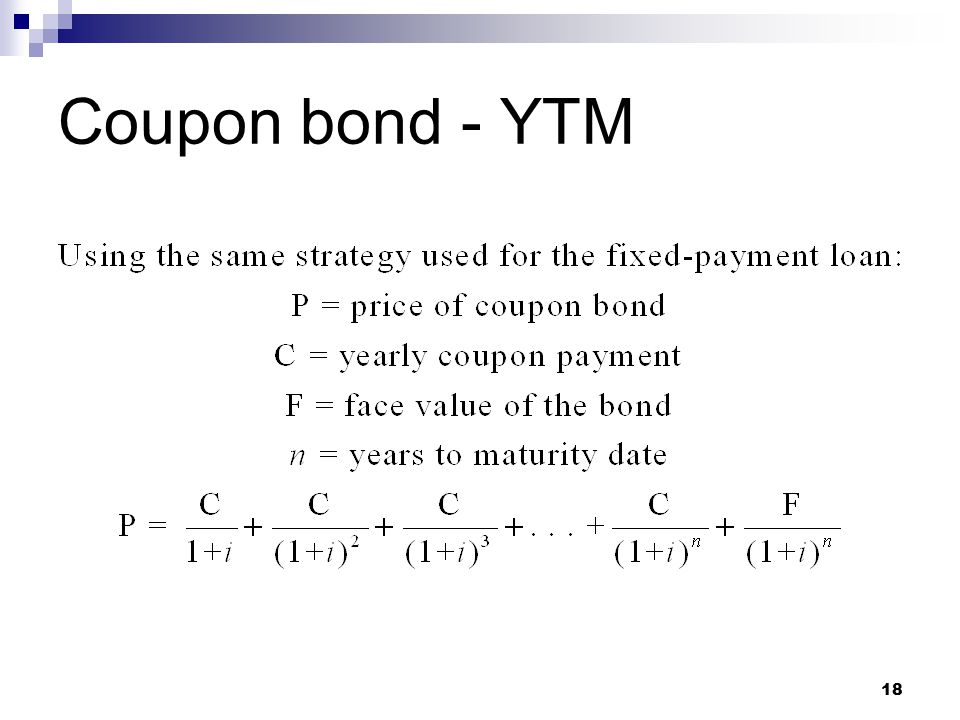

42 yield to maturity coupon bond

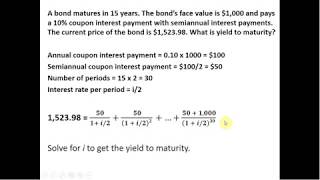

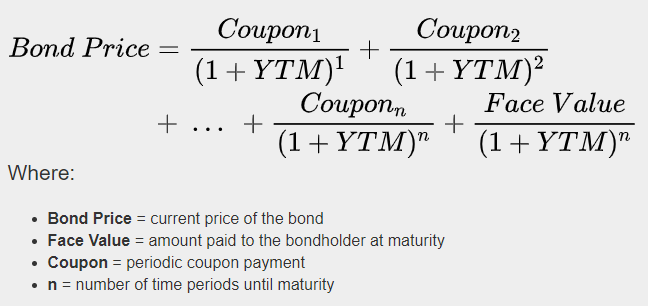

Solved Suppose a ten-year, bond with an coupon rate and - Chegg Expert Answer. 83% (6 ratings) Transcribed image text: Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt 1 8 of 10 (6 complete) P 6-12 (similar to) Suppose a ten-year $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.89. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Yield to maturity coupon bond

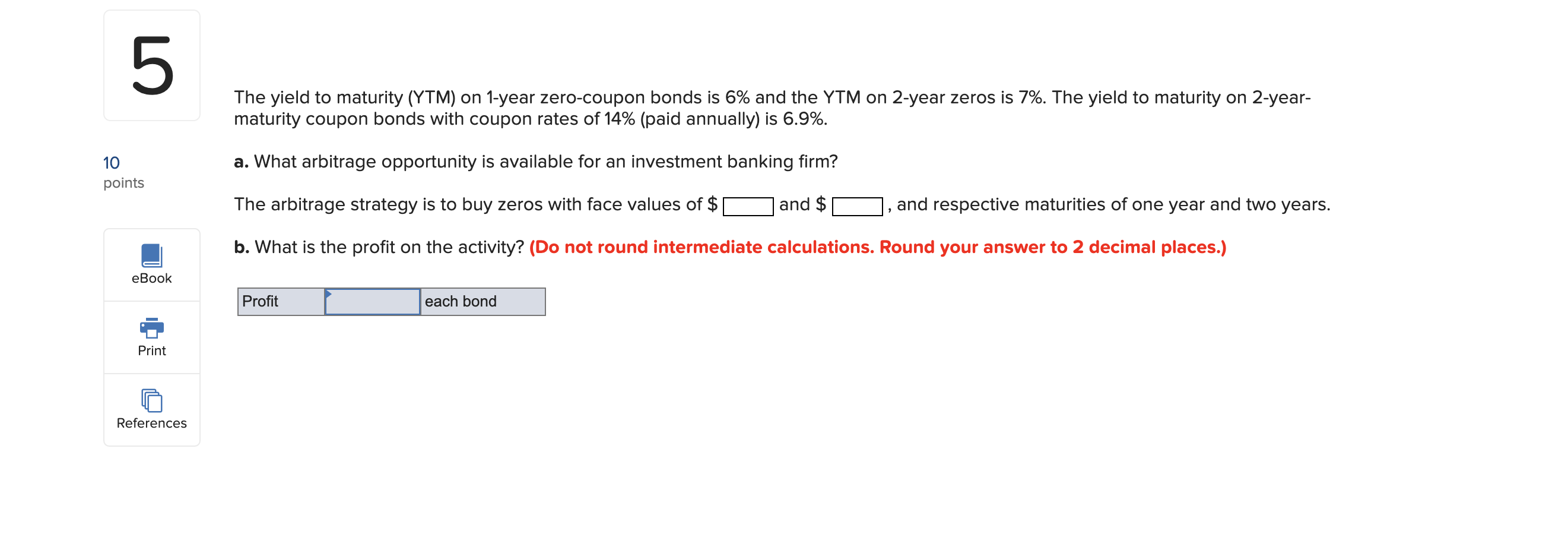

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Yield to Maturity Questions and Answers | Homework.Study.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 12% (paid annually) is 5.... View Answer. There is a 5.8 percent coupon bond with eleven years to maturity and a current price of $1,059.80.

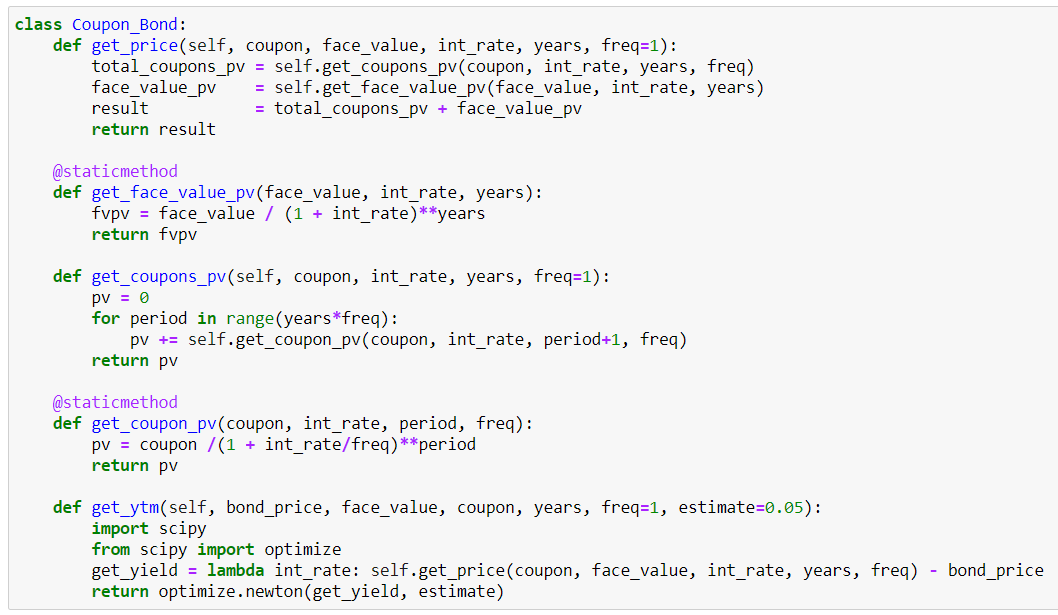

Yield to maturity coupon bond. How to Calculate the Price of Coupon Bond? - WallStreetMojo The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. The coupon ... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. yield to maturity.docx - A 5.40 percent coupon bond with 17... View Homework Help - yield to maturity.docx from BUSN D003 at American Public University. A 5.40 percent coupon bond with 17 years left to maturity is offered for sale at $955.62. ... Compute Bond Price Compute the price of a 3.8 percent coupon bond with 15 years left to maturity and a market interest rate of 6.8 percent. (Assume interest ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

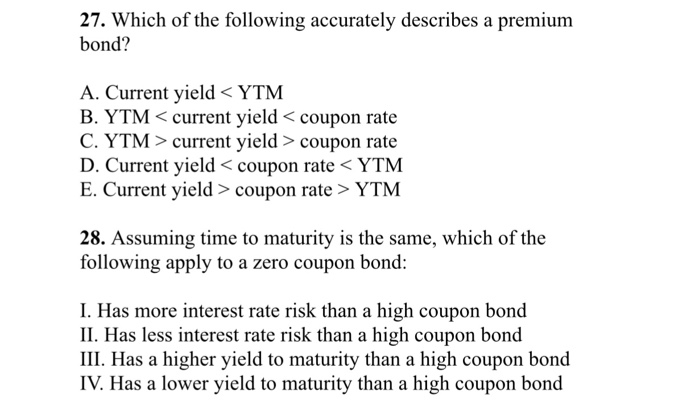

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Current yield - Wikipedia fluctuations in the market price of a bond prior to maturity. Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon ... Yield to Maturity (YTM): Formula and Bond Calculator - Wall Street Prep From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. How to Calculate Yield to Maturity (YTM)

Yield to Maturity : r/bonds - reddit.com Right now bonds are yielding above their issue interest rate, say a 2 year issued at 3% is now over 4% since the price has fallen to around $97-98. If I buy that bond at $97, I will get the coupon dividends until the time of maturity, plus at maturity I will get back the original $100 for a $3 profit, hence the higher calculated interest rate.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate Yield to Maturity of a Zero-Coupon Bond Reviews & Ratings Best Online Brokers Best Savings Accounts Best Home Warranties Best Credit Cards

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Yield to Maturity Calculator In case a bond's coupon rate = YTM, THEN the bond is selling at par. In case a bond's coupon rate < YTM, THEN the bond is selling at a discount. Example of a calculation. Let's assume a bond with the following characteristics: - face value = $100,000 - current clean price = $140,000 - yearly coupon payment = $10,000 - years to maturity = 10.

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit]

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market.

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

What is the yield to maturity for a 3 year bond with a 10% annual ... At par means the bond or stock is trading at its face value , A bond's yield is equal to its coupon when it trades at par. For the risk of lending money to the bond issuer, investors anticipate receiving a return equivalent to the coupon. Therefore the yield of maturity will be 10% itself , Option C is the right answer.

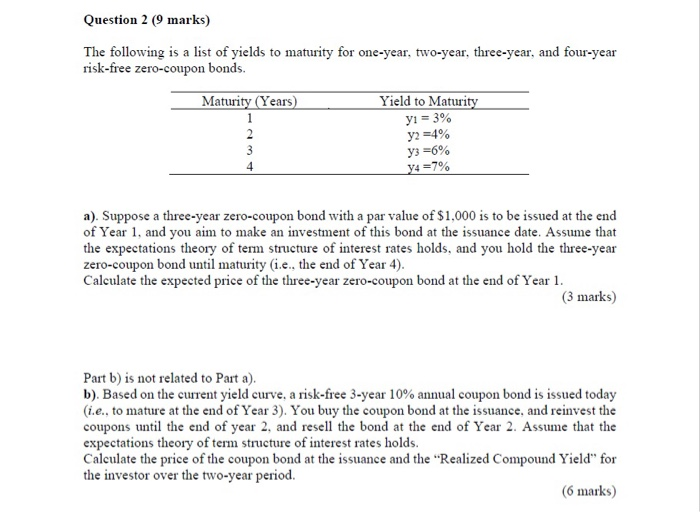

Yield to Maturity Questions and Answers | Homework.Study.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 12% (paid annually) is 5.... View Answer. There is a 5.8 percent coupon bond with eleven years to maturity and a current price of $1,059.80.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

:max_bytes(150000):strip_icc()/YTM-356ce239fec6426696be4b7e3c58c5aa.jpg)

Post a Comment for "42 yield to maturity coupon bond"