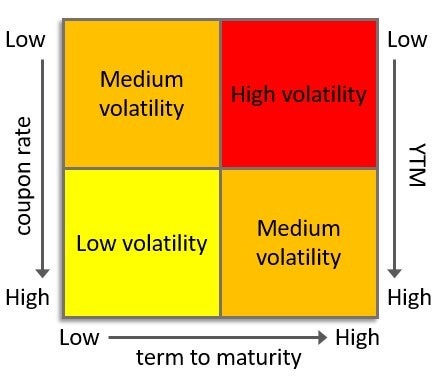

41 coupon rate vs ytm

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Yield to Maturity vs Coupon Rate: What's the Difference If you purchase the bond at face value, the YTM and the coupon rate are the same. Otherwise, the YTM increases or decreases depending on whether you've purchased a discount or premium bond. Compare the Yield to Maturity vs Coupon Rate Before Purchasing Bond. Investing your money is not an action you should take lightly.

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Coupon rate vs ytm

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The yield or yield to maturity defines how much you will be paid in the future: 6: Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond : Current yield = Annual Payments / Market Value of the Bond; Approx YTM = (C + (F-P)/n)*2/(F+P) 7: The Coupons are fixed; no matter what price the bond trades for. Yield and prices are inversely related. 8 Bond Yield | Nominal Yield vs Current Yield vs YTM Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Coupon rate vs ytm. Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Generally, the market interest rate and the coupon rate are the same when the bond is first issued. The coupon rate is also different from the yield to maturity (YTM). The yield to maturity ... Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Yield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. ... Formula for yield to maturity for zero-coupon bonds = Example 1. Consider a 30-year zero-coupon bond with a face ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Coupon vs Yield | Top 5 Differences (with Infographics) Definition. The coupon is similar to the interest rate, which is paid by the issuer of a bond to the bondholder as a return on his investment. The yield to maturity of a bond is the interest rate for a bond, which is calculated on the basis of coupon payment and the current market price of a bond. Basis of calculation. Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples... Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Difference Between Coupon Rate and Yield of Maturity Yield to Maturity = (C + (F-P)/n)*2/(F+P) 7; No matter at whichever price the bond is traded, the coupons are fixed. The prices and yield are inversely related to each other. 8; The coupon rate is equal to the yield of maturity. The yield of maturity is higher than the coupon rate because an investor purchases the bond at a discount. Coupon Rate - Meaning, Calculation and Importance - Scripbox YTM vs Coupon Rate . Basis of Difference: Yield to Maturity (YTM) Coupon Rate: Meaning: YTM is the rate of return a bondholder enjoys by holding the bond until maturity. Coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Payments:

Yield to Worst (YTW): Formula and Bond Excel Calculator Coupon Rate: 6%. Annual Coupon: $60. Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)". By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

What is a Coupon Rate? | Bond Investing | Investment U For long-term investors, coupon rate is a more important factor than YTM. This is because they're more likely to depend on the interest payouts of the bond. Therefore, a higher coupon means a higher payment. Conversely, bond traders prefer YTM because they're acquiring bonds in a secondary market, where carrying value matters more.

Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser.

Post a Comment for "41 coupon rate vs ytm"