39 bond yield vs coupon rate

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon... Bond Yield Rate Vs Coupon Rate - TiEcon 2018 A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it normal balance generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Bond yield vs coupon rate

Current Yield vs. Yield to Maturity: What's the Difference? A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1. Bond Yield Rate Vs. Coupon Rate: What's The Difference? A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond or the price of the bond as acknowledged by the issuing entity. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Bond yield vs coupon rate. Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ... Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis The coupon rate of a bond represents the amount of actual interest that is paid out on a bond relative to the principal value of the bond (par value). Finding the coupon rate is as simple as dividing the coupon payment during each period divided by the par value of the bond. This is often referred to as the stated rate. Bond Yields Explained Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) For example, consider a bond with a coupon rate of 2% and another bond with a coupon rate of 4%. Keeping all the features the same, bond with a 2% coupon rate will fall more than the bond with a 4% coupon rate. Maturity affects interest rate risk. The longer the bank's maturity, the higher the chances of it being affected by the changes ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond. While current yield generates the return annually depend on the market price fluctuation. Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country's economy. Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

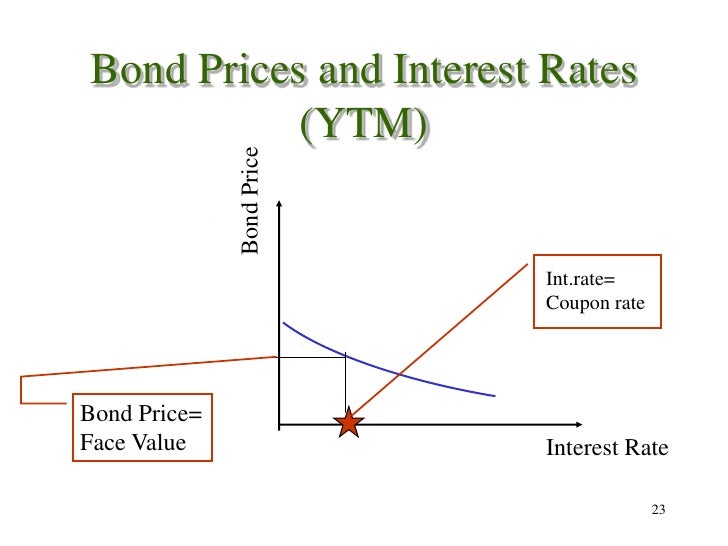

Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ... Bond Yield and Return | FINRA.org Coupon yield is the annual interest rate established when the bond is issued. It's the same as the coupon rate and is the amount of income you collect on a bond, expressed as a percentage of your original investment. If you buy a bond for $1,000 and receive $45 in annual interest payments, your coupon yield is 4.5 percent. Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. For instance, say a bond at issuance is priced at 100 with 10% coupons. You pay 100 initially and receive 10% coupons over the life of the bond. Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ...

Bond yield vs coupon rate: Why is RBI trying to keep yield down? For example, if the price of the 10-year bond with fave value of Rs 1,000 and coupon rate of 6 per cent falls to Rs 600 in the secondary market, it will still fetch the interest of Rs 60 per year...

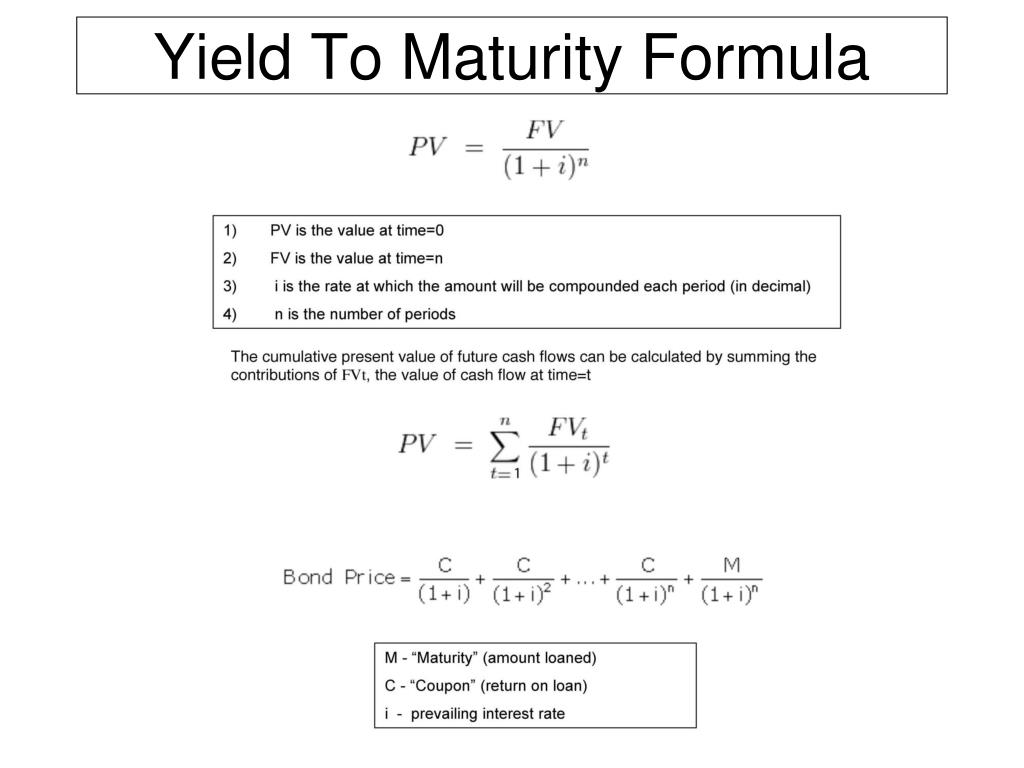

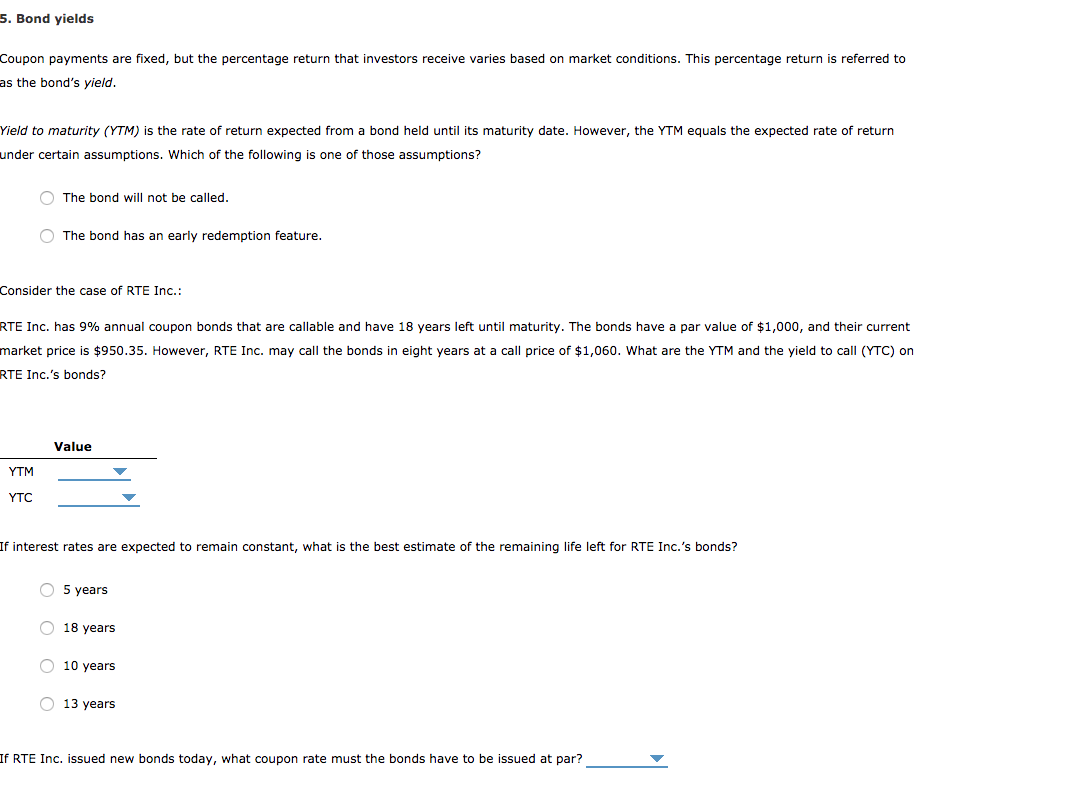

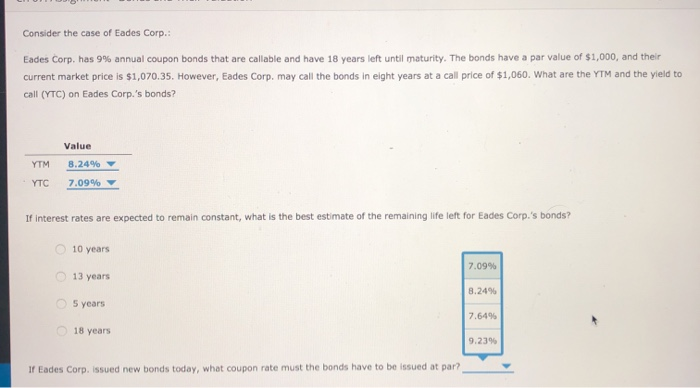

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Explaining Yields vs Coupon rate of Bonds - Orb52 For example when issuing the bonds, if they are issued at a face value of ₹10,000 and the coupon rate on the bond is 10% then the interest rate that will be paid is ₹1,000. But when the Price of the bond fell to ₹9500, then even in such a situation the interest that will be received is still ₹1,000.

How are bond yields different from coupon rate? - The F The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

What Is the Coupon Rate of a Bond? - The Balance In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the current price of the bond.

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary:

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Bond Yield Rate Vs. Coupon Rate: What's The Difference? A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond or the price of the bond as acknowledged by the issuing entity.

Current Yield vs. Yield to Maturity: What's the Difference? A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1.

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

Post a Comment for "39 bond yield vs coupon rate"