39 coupon rate and yield

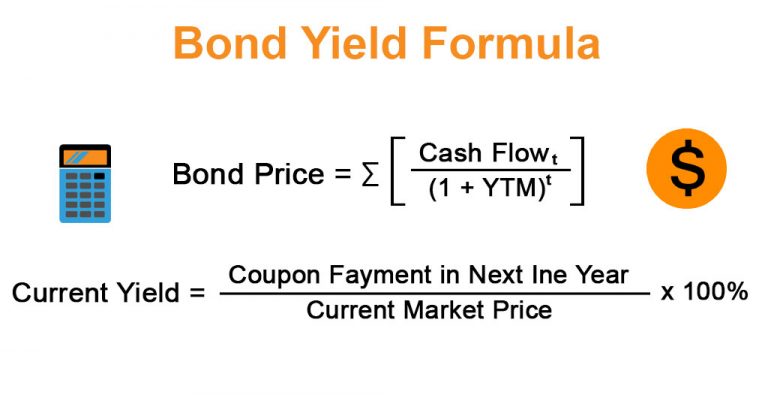

Bond Yield: Definition & Calculation with Interest Rates The yield will differ from the coupon rate if the price of a bond is above or below face value. Types of Bond Yields. The various types of bond yields are: 1. Current Yield. Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Coupon rate and yield

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Coupon rate and yield. What is the Difference Between Yield & Coupon Rate Summary. 1.Yield rate and coupon rate are financial terms commonly used when purchasing and managing bonds. 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face ... Coupon Rate - Meaning, Calculation and Importance This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. What is Coupon Rate in Bonds? The coupon rate for bonds is the interest bond issuer pays on the face value of the bond. In other words, it is the periodic interest that the issuer of the bond pays the ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

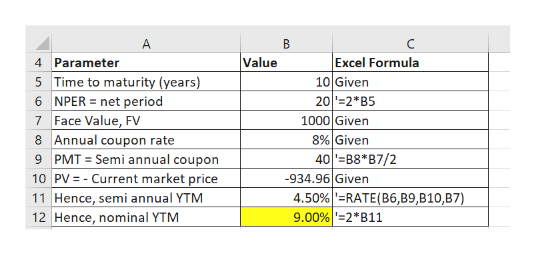

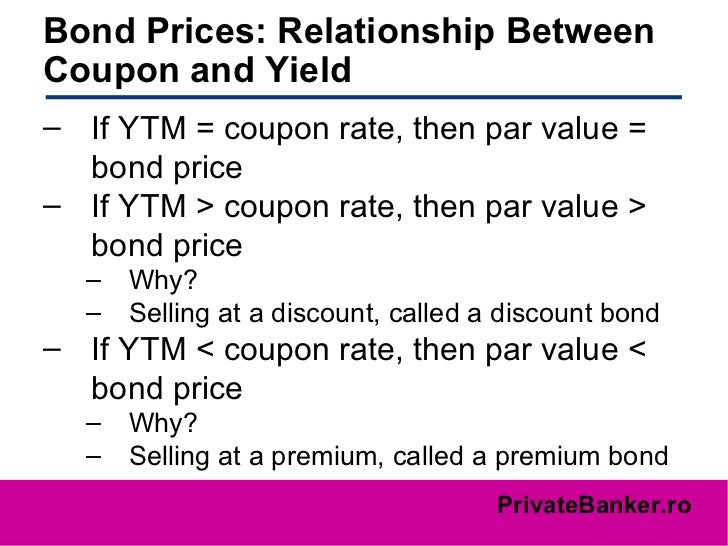

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. What Is a Coupon Rate? How To Calculate Them & What They're Used For Nominal yield is also referred to as nominal rate or coupon yield. It is the coupon or interest rate on a bond that the bond issuer promises to pay the bond purchaser. This rate is fixed and is valid throughout the life of the bond. For instance, imagine you have a bond with a face value of $2,000, that pays you $100 in interest annually. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Solved Calculate the yield-to-maturity on a coupon bond that | Chegg.com Business; Finance; Finance questions and answers; Calculate the yield-to-maturity on a coupon bond that has a 5% annual coupon rate and face value F= $100 due in 2 years from now if the bond is currently traded at price $105. Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... What is coupon rate and yield in bonds.docx - What is coupon rate and ... Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. A bond's yield is the rate of A bond's yield is the rate of return the bond generates. Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is 5-year Treasury Yield and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

coupon and yield : bonds Coupon refers to the stated interest rate of the bond. A 5% coupon is $50, etc. Yield refers to the % received buying the bond and can be measured on different end-points (yield to maturity, yield to worst, etc.), and is influenced by the purchase price of the bond (if you buy below par, the yield will be higher than the coupon, if you buy ...

Answered: You find a bond with 27 years until… | bartleby 57. Transcribed Image Text: You find a bond with 27 years until maturity that has a coupon rate of 9.0 percent and a yield to maturity of 8.1 percent. Suppose the yield to maturity on the bond increases by .25 percent. a. What is the new price of the bond using duration and using the bond pricing formula? (Do not round intermediate calculations.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Popular Course in this category

Bond Yield Formula | Step by Step Calculation & Examples And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300 Coupon Rate = 6% Bond Price = $1600 Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Difference Between Current Yield and Coupon Rate (With Table) The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

How do I Calculate Zero Coupon Bond Yield? (with picture) The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds. A bond is a note that companies sell to raise money — investors trade the purchase price for a future ...

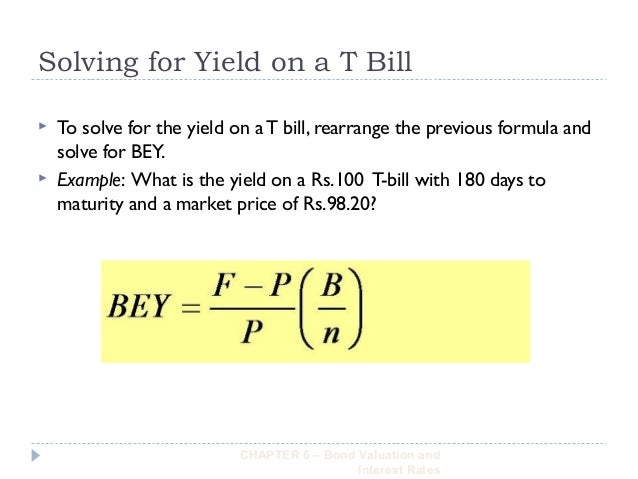

What is the effective annual yield formula? In this example, the annual effective yield is calculated thus: Annual percentage yield = (1.03)^12 - 1 = . 43 = 43%, where 1.03 is 1 plus the monthly interest and 12 is the number of times in a year interest is compounded. It is also known as the annual effective yield.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%.

Post a Comment for "39 coupon rate and yield"